Content

In this case, you will observe that you will get a slight downward slant in the wedge pattern by connecting the lower highs and lows before rising prices. This will eventually lead to a falling wedge breakout to continue on the larger uptrend formation. What is important in this method is to lace the stops at the appropriate places so that there is some space available before the final closing out of any trade. By putting the stop loss some significant distance away, this technique would permit a breakthrough resistance in the market, thereby continuing on a long going uptrend. Falling wedge patterns should also be used in combination with other forms of technical analysis and due diligence. Here is what needs to be present when looking for a falling wedge pattern.

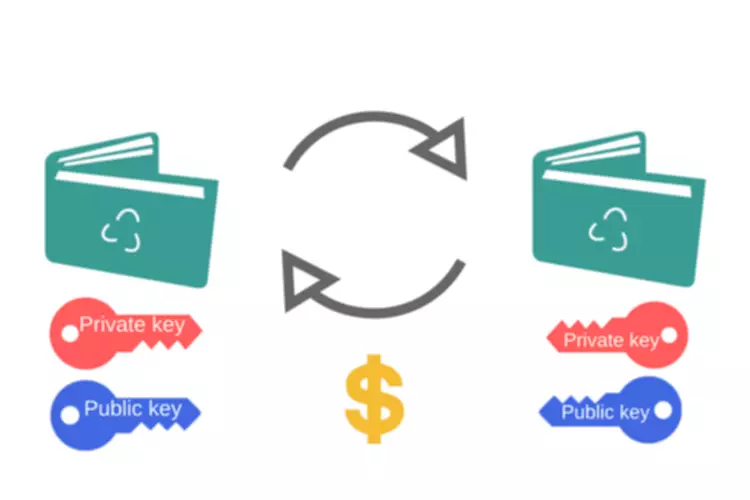

In crypto, identifying wedge patterns means identifying opportunities to make greater profits. When traders successfully pin what could possibly be a wedge pattern and end up being right, they earn a lot. This is why wedge patterns are so essential to the art of trading cryptocurrency. This area forms the base of the pattern and is an important feature to be noted by traders. During this period the price tends to form equal lows or slightly higher slows than the previous lows.

- The lower trend line act as a support line and will be sloping downwards as the downtrend continues.

- Since the rising wedge pattern has a particularly distinct configuration, it can advise traders and investors to look out for impending top and reverse prices.

- In the case of a reversal trend, the wedge will start to form at the bottom point of a bearish trend in the market.

- This makes trading breakouts from this pattern more challenging than narrowing patterns such as triangles, and pennants.

- A third wave kinds later on however the sellers lose control again after the formation of brand-new floors.

- When it comes to the speed we execute your trades, no expense is spared.

As you’ve seen on the charts, trend lines are used not only to form the patterns but become support and resistance. For ascending wedges, for instance, traders will mostly be mindful of a move above a former support point. On the other hand, you can apply the general rule that support turns into resistance in a breakout, meaning the market may bounce off previous support levels on its way down. Due to this, you can wait for a breakout to start, then wait for it to return and bounce off the previous support area in the ascending wedge. The descending broadening wedge consists of 2 non-parallel pattern lines that are moving downwards. In the chart below, the development started on October 21, 2021, before the bullish breakout on November 4, 2021.

Trading the Falling Wedge Pattern

You can apply the general rule here – first is that the former levels of support will become new resistance levels, and vice versa. Secondly, the range of the former channel can show the size of a subsequent move. Another common indication of a wedge that is close to breakout is falling volume as the market consolidates. A spike in volume after it breaks out is a good sign that a bigger move is nearby. It ultimately make an apex , but wedges trade very differently than standard triangle patterns. Setting the stop loss a sufficient distance away allowed the market to eventually break through resistance and resume the long-term uptrend.

From this buy signal, the S&P breaks out upwards out of this falling wedge and actually gaps up when it breaks out, indicating very bullish momentum for the Index. The falling wedge continuation pattern appears within a downtrend when price tends to consolidate, or trade in a more sideways fashion. Technical analysis is more of an art rather than science, and as such some form of leeway should be made.

It’s essential to keep in mind that the market is constantly changing. So past performance is not necessarily indicative of future results. As such, using multiple tools and techniques when making trading decisions is always a good idea.

Is a Symmetrical Triangle Pattern Bullish or Bearish?

A third wave kinds later on however the sellers lose control again after the formation of brand-new floors. The descending broadening wedge pattern can extend for long dual moving average crossover periods on rising volatility. Because the two “arms” are moving apart there’s no “crossing point” to the pattern like there is with a pennant, a wedge or triangle. Because the rising wedge pattern is commonly seen after prolonged trends, it can be very useful and effective in trading Bitcoin and other cryptocurrencies.

In contrast to symmetrical triangles, which have no definitive slope and no bias, falling wedges definitely slope down and have a bullish bias. Together with the rising wedge formation, these two create a powerful pattern that signals a change in the trend direction. In general, a falling wedge pattern is considered to be a reversal pattern, although there are examples when it facilitates a continuation of the same trend.

Falling Wedge Pattern: Ultimate Guide

No matter your experience level, download our free trading guides and develop your skills.

When the pattern has completed it breaks out of the wedge, usually in the opposite direction. The bullish bias of a falling wedge can’t be confirmed until a breakout. Traders can make use of falling wedge technical analysis to spot reversals in the market.

A spike in volume after it breaks out is a good sign that a bigger move is on the cards. There can sometimes be a correction to test the newfound support level just to make sure it holds and is a valid breakout. We research technical analysis patterns so you know exactly what works well for your favorite markets. A descending triangle forms with an horizontal resistance and a descending trendline from the swing highsTraders can… Consider other chart patterns like the head and shoulders, double top and double bottom in order to develop your pattern recognition.

Learn to trade

Trading methodology based on astronomical and Gann based time cycles with a focus on price action only charting for trade execution and trade management. ForexDominion is a purely informational website and in no case does its information imply investment advice. This gives you a few more options when trading these in terms of how you want to approach the entry as well as the stop loss placement.

It is a type of pattern development in which trade operations are limited to convergent straight lines, thereby making a pattern. The wedge normally requires roughly 3 to 4 weeks to finish its formation. This formation has a tilted slant that rises or falls in the same way. This is measured by taking the height of the back of the wedge and by extending that distance up from the trend line breakout. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances.

quiz: Understanding Three drives pattern

It will draw real-time zones that show you where the price is likely to test in the future. Both of the boundary lines of a falling wedge tilt downwards from the left to the right. This pattern normally develops when the price of an asset has been growing over time, although it may also happen during a downward trend.

The material gives an example of trade that we took based on falling wedge pattern. Though, such clean trades do not always come in front of a trader, one can use the concept to execute trades with stop loss levels given in the material. The second is that the range of a previous channel can indicate the size of a subsequent move. In this case, it’s often the gap between the high and low of the wedge at its outset.

quiz: Understanding Butterfly pattern

Test yourself with our interactive forex trading patterns quiz. Traders can look to the volume indicator to see higher volume in the move up. Additionally, divergence can be observed as the market is making lower lows but the stochastic indicator is making higher lows – this indicates a potential reversal.

Falling Wedge Pattern

The Descending Right-Angled Broadening Wedges have a descending trendline below the horizontal trend line with price action in between. The Ascending Right-Angled Broadening Wedges have an ascending trendline above the horizontal trendline with price action in between. Broadening Tops and Bottoms are wedges in price action that open outwards. They represent increasing volatility within a broadening range. Ascending Broadening Wedges tend to breakout in the direction of the previous price trend and so act as continuations of this move.

A stop-loss order should be placed within the wedge, near the upper line. Any close within the territory of a wedge invalidates the pattern. You can see that in this case the price action pulled back and closed at the wedge’s resistance, before eventually continuing higher on the next day.

This article explains the structure of a falling wedge formation, its importance as well as technical approach to trading this pattern. We will discuss the rising wedge pattern in a separate blog post. The take https://xcritical.com/ profit target is measured by taking the height of the back of the wedge and by extending that distance down from the entry. The slowing of momentum is noted, and it usually precedes a reversal to the downside.

Out of all the chart patterns that exist in a bullish market, the falling wedge is an important pattern for new traders. As with rising wedges, the falling wedge can be one of the most difficult chart patterns to accurately recognize and trade. When lower highs and lower lows form, as in a falling wedge, a security remains in a downtrend. The falling wedge is designed to spot a decrease in downside momentum and alert technicians to a potential trend reversal.